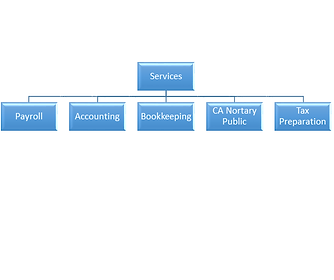

Practice Areas

In whatever area you need assistance a professional is ready to assist you.

Taxes

Professional preparation of individual returns tailored to your specific situation whether as an individual, sole proprietor, partnership, or corporation.

For instance, individuals who have medical, unreimbursed employee expenses or pay property taxes on a home may be eligible to claim an itemized deduction.

For small businesses have a professional take the stress and complexity of reporting business income of your shoulders. Have the peace of mind knowing that a professional will take the time to answer all questions and identify the corresponding deductions.

Accounting

Thees services take your various business transactions and transform the raw data into useful and valuable information about the current health of the business.

The information is presented in the form of various reports that synthesis specific area of a business. Such reports include balance sheets, the profit or loss in a specific time frame, a record of how much customers owe you among other reports

Having reports prepared by an accountant can allow you to keep track of the growth of your company by comparing the same reports in different time frames.

Payroll

Whether you have one or thousands of employees employees are the driving force of any company's success. Moreover, it has been established that employees who are happy will likely worker harder and provide quality results for a company.

A professional understands that paydays are one of the most awaited days and behind every paycheck there are lives. For such reason, it is important that payroll is done on time and appropriately.

Likewise, company expansion the number of employee increase and it can be difficult to keep a record of all the components of payroll such as vacation, sick pay, proper amount of withholding among others. Make an appointment today and feel more at ease with your payroll needs.

Bookkeeping

Every type of business needs to maintain an accurate record of all business transactions. Keeping your company books clean and organized is very useful to make decisions and evaluate company health. However, a variety of factors can cause record keeping to become complex and time consuming. Such factors include the volume, the rapidness in which transactions occur, identifying the proper classification of each transaction on a daily basis.

Moreover, since bookkeeping is the foundation on which an accountant evaluates and analyzes the financial position of a business it is recommended that an accountant verifies for completeness and accurate. For such reason, having your bookkeeping done by an accountant results in quality and efficiency.

Notary Public Services

Whether you need an acknowledgement or a jurat to notarize a document